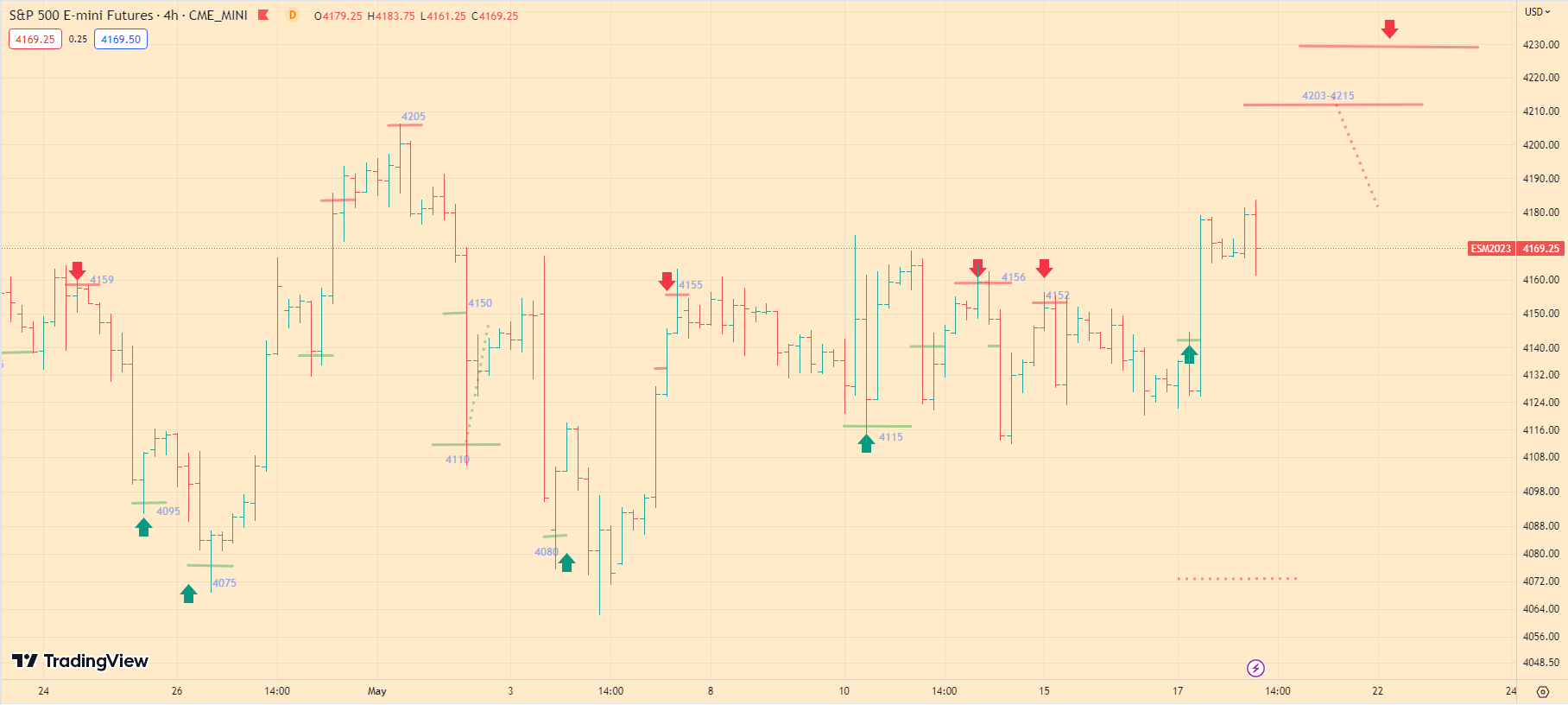

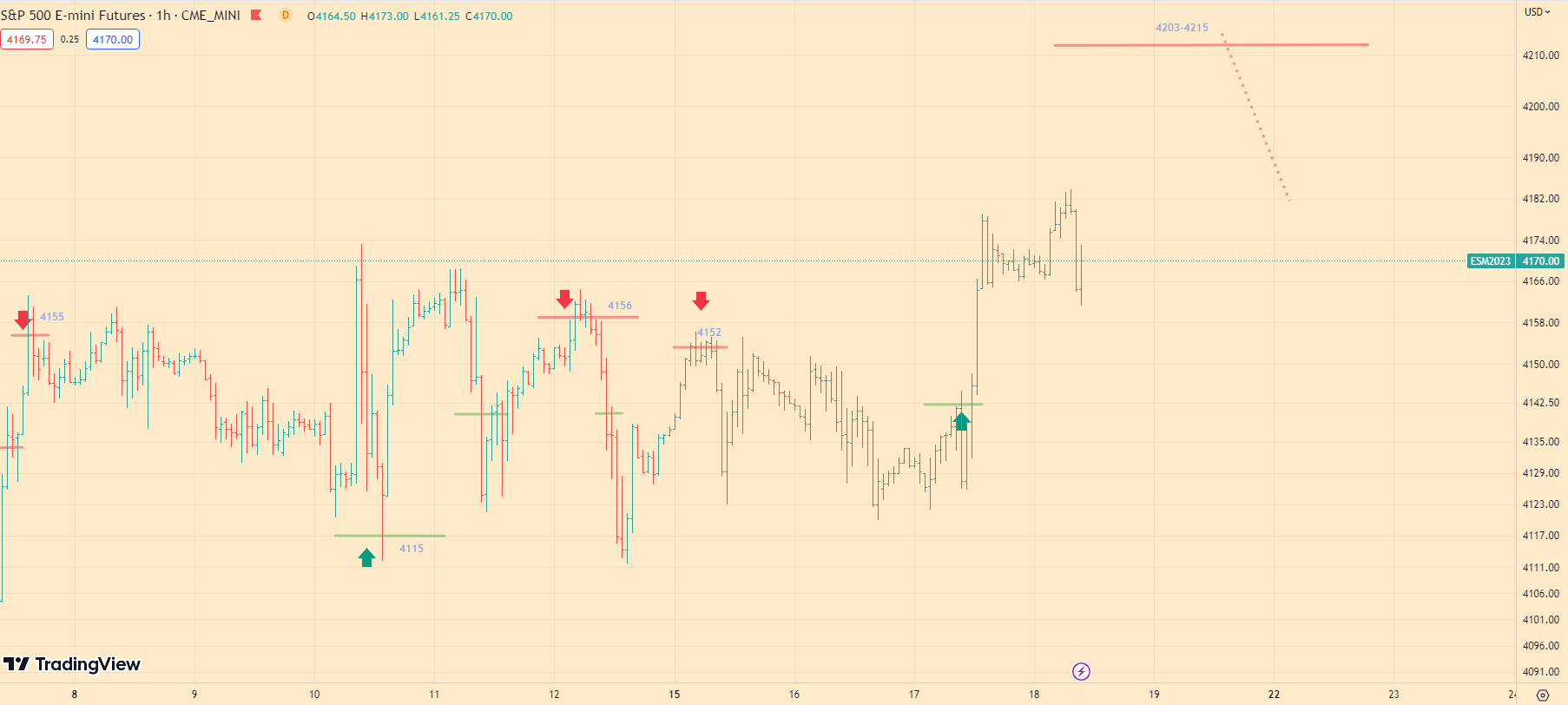

SP500 Technical Analysis ES1! futures S&P 500 Index 5-18-23

Today’s Market Overview:

At the opening of the market, we witnessed the index make its final attempt to rise to the level of 4190, which was successful. Now let’s take a look at how it transpired throughout the trading day.

As I mentioned before, in the first half of the day at the market opening, the index attempted to reach the mark of 4150. Speculators tried to flip the market down, their target was the level of 4000. However, their attempt failed, and they were forced to close their positions, which I previously mentioned. This situation led to a moment when there were no sellers on the market, and this very absence of sellers triggered a sharp rise in the index to the level of 4195, about which I also told you over the past few days.

A few days ago, I also mentioned that large investment companies, such as Bank of America and Goldman Sachs, moved their stop orders from the level of 4180 and raised them higher, to the level of 4195. But at the moment, they have once again moved their positions. Now their orders are located at levels between 4203-4215.

Thus, currently, the market has all the prerequisites for continued growth to the level of 4203-4215. However, speaking of the orders that remained at the previous level of 4195, about which I told you earlier, this level is no longer critically important. Although there are still orders for opening short positions from speculators here, they are not significant for the market.

If you didn’t see my analysis yesterday, you can check it out here.

What to expect today:

Give me a thumbs up if you agree with today’s trading idea. Also, remember to contact me in 2-3 days for further trading advice. If you have any questions about my analytics and trading logic, I recommend reading the FAQ. Please share a link to my blog to help promote it. Follow me on Twitter to stay up-to-date on the S&P 500 index. Additionally, visit my About Me page to get to know me better.