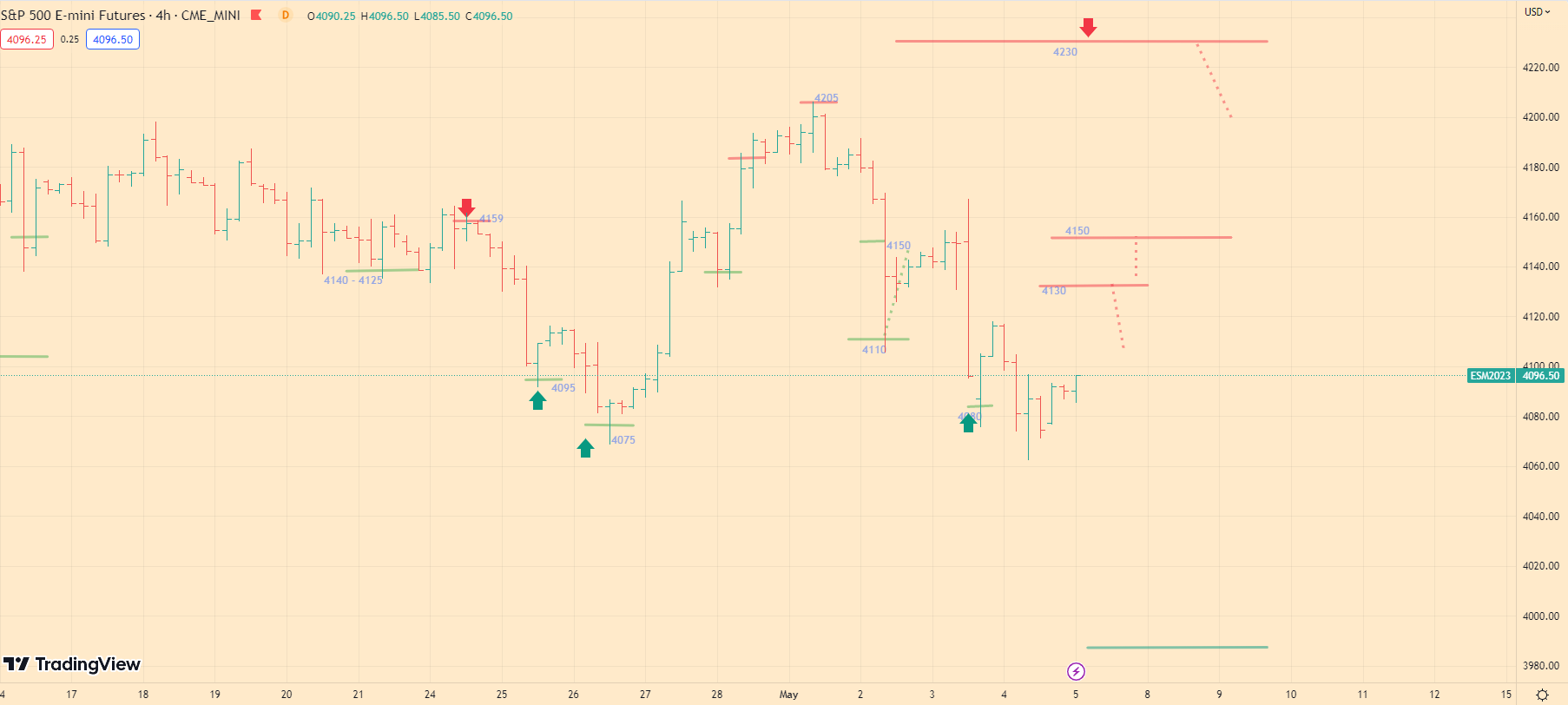

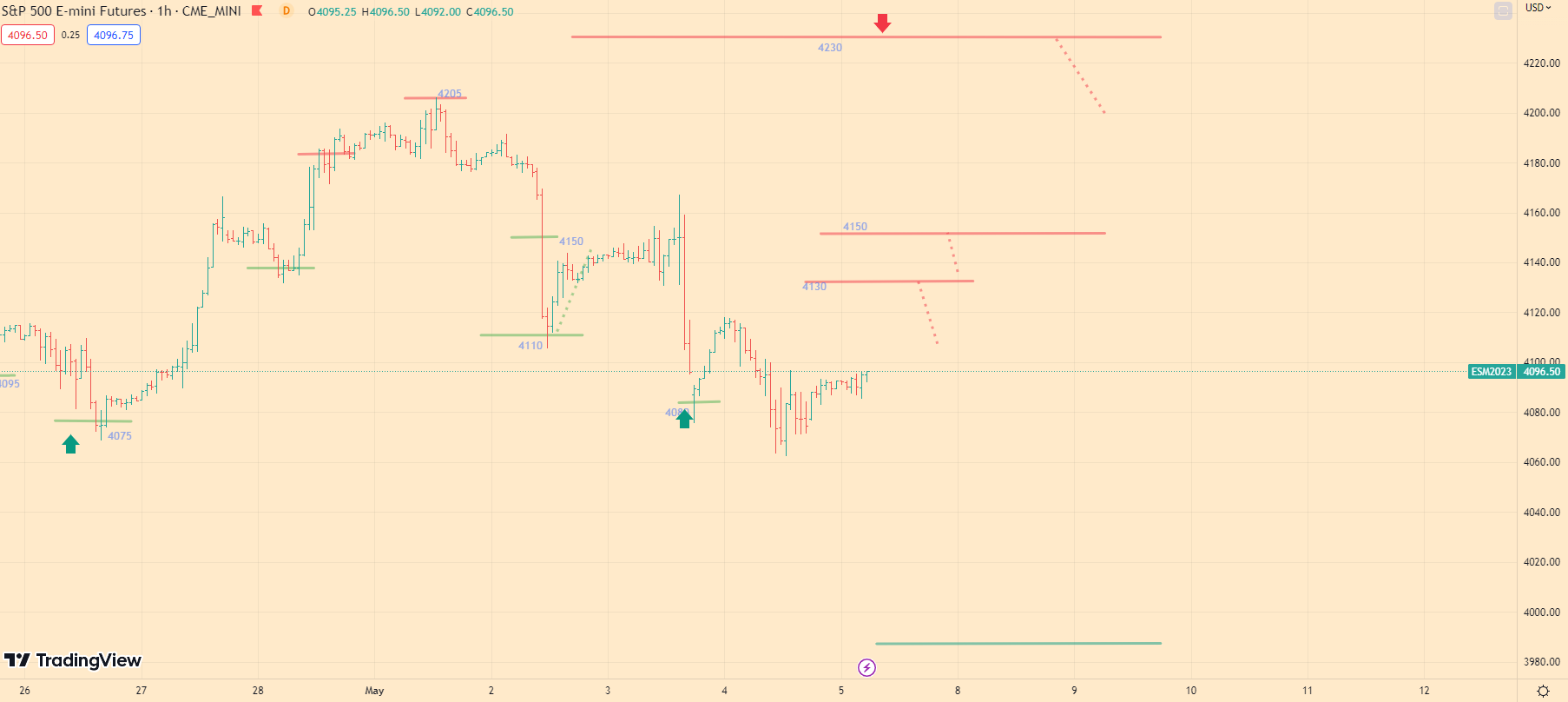

SP500 Technical Analysis ES1! futures S&P 500 Index 5-05-23

Today’s Market Overview:

Yesterday, at the market opening, we saw a sharp decline in the index caused by the need for funding in investment banks, which I mentioned earlier. However, I also mentioned yesterday that in the near future, I expect the index to rise to the 4130-4160 level, where, in my opinion, there will be an attempt to reverse the index to a level below 4000.

The main reason for such a sharp drop will be a favorable market situation for closing a series of long positions in large investment companies, in order to release funds for the stress resilience of the banking system. In addition, major players such as JP Morgan, Bank of America, and Goldman Sachs will be looking for opportunities to increase their positions exclusively below 4000 in the current market situation.

The main reason for this is the fact that their weighted average price across portfolios is somewhere around 3900. This provides speculators with huge trading opportunities at the moment. The recent decision by the US Federal Reserve System forces the banking system to consider new financial obligations.

If you didn’t see my analysis yesterday, you can check it out here.

What to expect today:

At today’s market opening, at the beginning of the trading day, I expect the index to attempt stabilization and rise to the 4130 – 4150 level. Experienced speculators will begin opening short positions with the goal of moving to a level below 4000. The main reason for such trading will be the elementary knowledge of the fact that large investment companies and banks will be increasing their positions below 4000.

Thus, the market will experience pressure from experienced speculators. However, if this attempt to grow to the 4130-4150 level is broken, we will see a sharp movement of the index to a level below 4000, somewhere around 3980.

Give me a thumbs up if you agree with today’s trading idea. Also, remember to contact me in 2-3 days for further trading advice. If you have any questions about my analytics and trading logic, I recommend reading the FAQ. Please share a link to my blog to help promote it. Follow me on Twitter to stay up-to-date on the S&P 500 index. Additionally, visit my About Me page to get to know me better.