SP500 Technical Analysis ES1! futures S&P 500 Index 5-22-23

Today’s Market Overview:

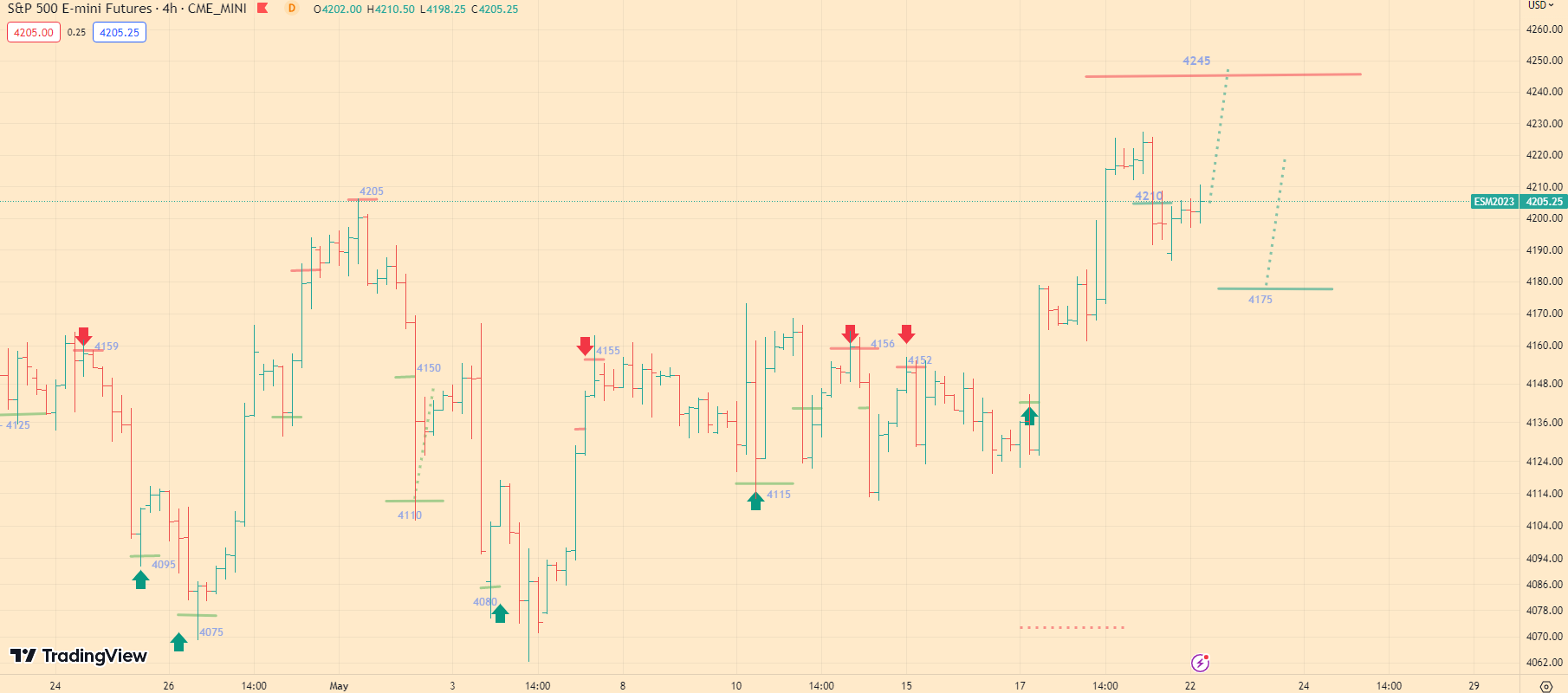

Last Friday, at the beginning of the trading day, we saw the market start to correct. While I was expecting this, I thought it would start from a slightly higher level than 42 45.

Friday became the day when many market participants tried to lock in their profits. Now let’s talk about what awaits us in the medium term on the market. Over the next 1-2 months, we can expect a peak at 4310. However, if the momentum doesn’t stop there, the index could rise to the 4500 level and reach this peak by July.

Looking at the medium-term perspective, we can see that the market is currently in a growth phase. Trading on such a market requires us to increase our positions on pullbacks. Last Friday, I marked on the chart that the nearest pullback could be to the 4210 level, where large speculators’ buy orders are placed. That’s why I was expecting a pullback in the market at the end of last week, but I assumed it would start from the 42 45 level.

Speaking about where orders are placed today, I would highlight the 4175 level, which has a large number of orders from speculators.

If you didn’t see my analysis yesterday, you can check it out here.

What to expect today:

Today, at the market opening, I expect the index to attempt to rise to the 4220 level, where a slight stabilization will occur, after which the index could continue its sharp rise to the 4280 level. However, if this growth is interrupted, we will see a continuation of the correction and a decrease in the index to 4175, where speculators’ orders are still placed from last Friday. In this case, I expect a more substantial correction that could take about 3-4 days in the market.

Give me a thumbs up if you agree with today’s trading idea. Also, remember to contact me in 2-3 days for further trading advice. If you have any questions about my analytics and trading logic, I recommend reading the FAQ. Please share a link to my blog to help promote it. Follow me on Twitter to stay up-to-date on the S&P 500 index. Additionally, visit my About Me page to get to know me better.