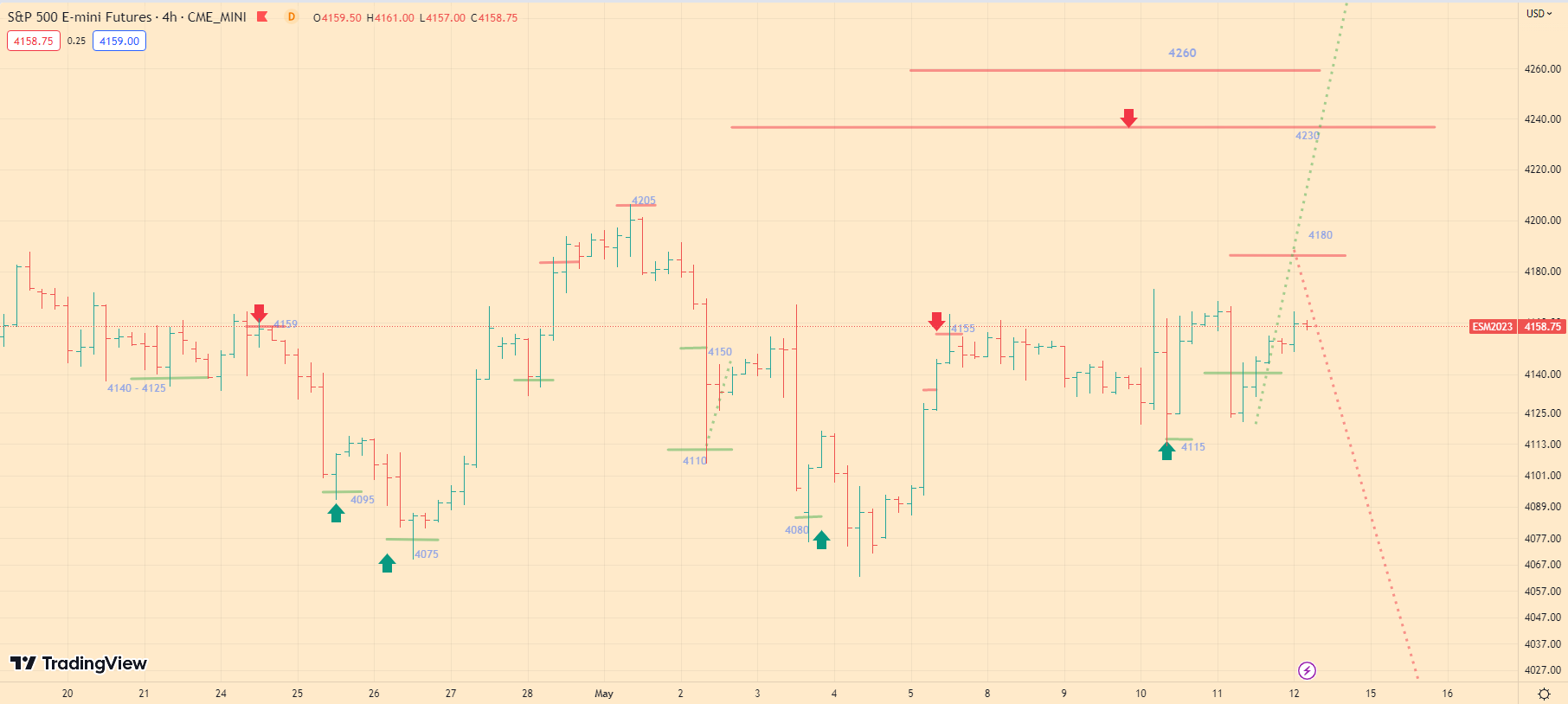

SP500 Technical Analysis ES1! futures S&P 500 Index 5-12-23

Today’s Market Overview:

Yesterday at market open, we saw the index sharply drop to the 4140 level. However, the movement was more abrupt than I expected, and the index fell a little further. After that, as I predicted, we witnessed further index growth. As I mentioned before, for several days the index has been trapped between the 4115 and 4180 levels, and trading is currently taking place within this range. We discussed the main reason for such behavior a few days ago.

Today, overall, I do not anticipate any significant changes, and my market expectations remain the same. The main reason for this is that major players continue to place their orders at the 4180 and 4115 levels. If you didn’t watch my video a few days ago, I talked about the need for large investment companies to carry out the funding process to secure their bond portfolios, requiring arbitrage transactions. It is precisely for the purpose of executing these arbitrage transactions that major players have been holding the index steady for the past few days. The reason for this is the increase in the Federal Reserve’s rate.

If you didn’t see my analysis yesterday, you can check it out here.

What to expect today:

Give me a thumbs up if you agree with today’s trading idea. Also, remember to contact me in 2-3 days for further trading advice. If you have any questions about my analytics and trading logic, I recommend reading the FAQ. Please share a link to my blog to help promote it. Follow me on Twitter to stay up-to-date on the S&P 500 index. Additionally, visit my About Me page to get to know me better.