S&P 500 Index Analytics on 10/14/22:

Today we’re here to talk about the S&P 500 Index.

What’s on the market now:

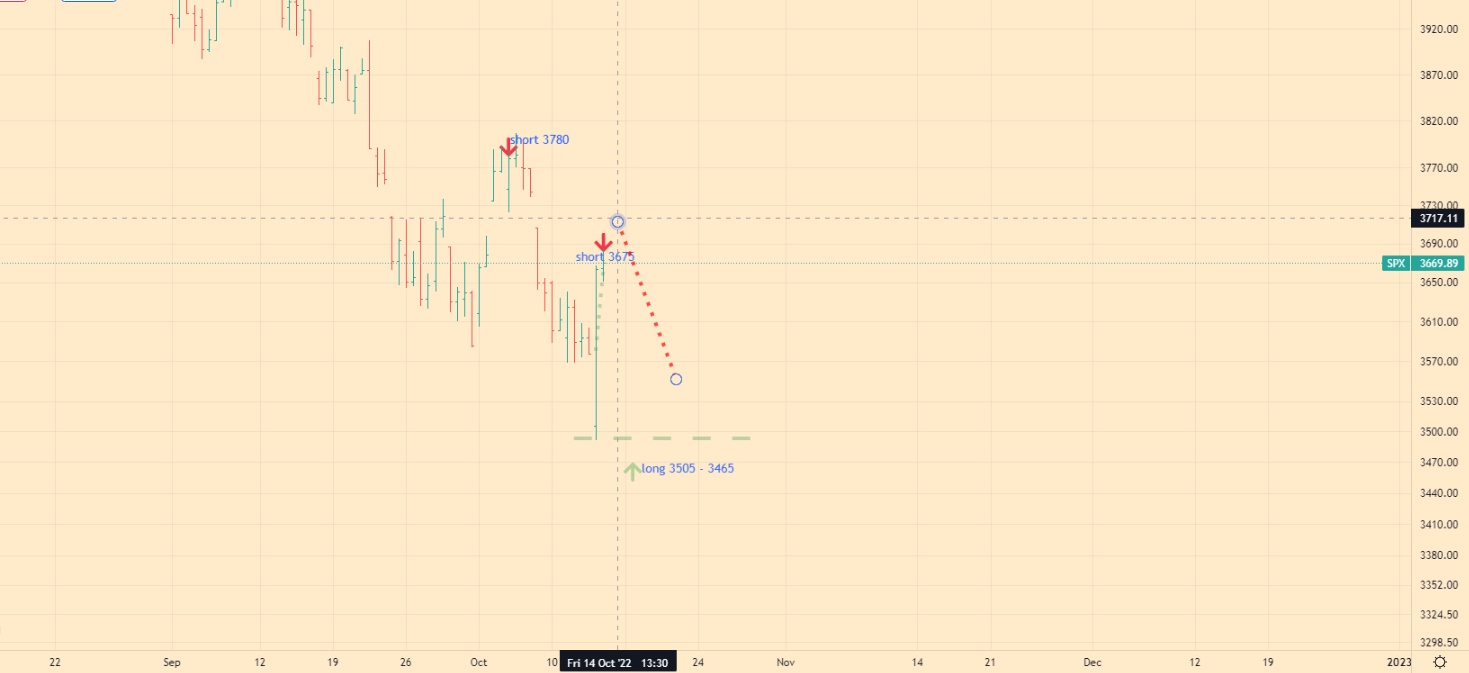

Today the index is trading at 3669. Yesterday we saw large volumes in the market. The market was very volatile and visited the target zones I mentioned earlier twice. First time at 3500 and second time at 3675 which I mentioned earlier.

However, today I change my expectations: Now I expect a new bottom at 3200-3160 and below.

What today:

Today I expect a stabilization in market motion at 3725 – 3675. And then the market will try to go down to the level of 3570 and below.

Here are my trading recommendations for today 10/14/22

What I recommend:

- If you want to open short:

Short positions are possible from the level of 3675-3725, this would be an ideal place to sell today, limit your losses. - If you want to buy:

Long positions are prohibited, limit your losses. - If you are not in the market:

Long positions are prohibited. If you want to open a short position, then it is better to do it from the level of 3675-3725, limit your losses.

Give me thumbs up. Also remember to contact me in 2 or 3 days for further trading advice. Also share a link to my blog, it will greatly help in its movement.

Follow me on Twitter to stay up to date with the S&P 500. Also visit page about meto get to know me better. If you like the content of my blog, you can make a donation to support the blog.