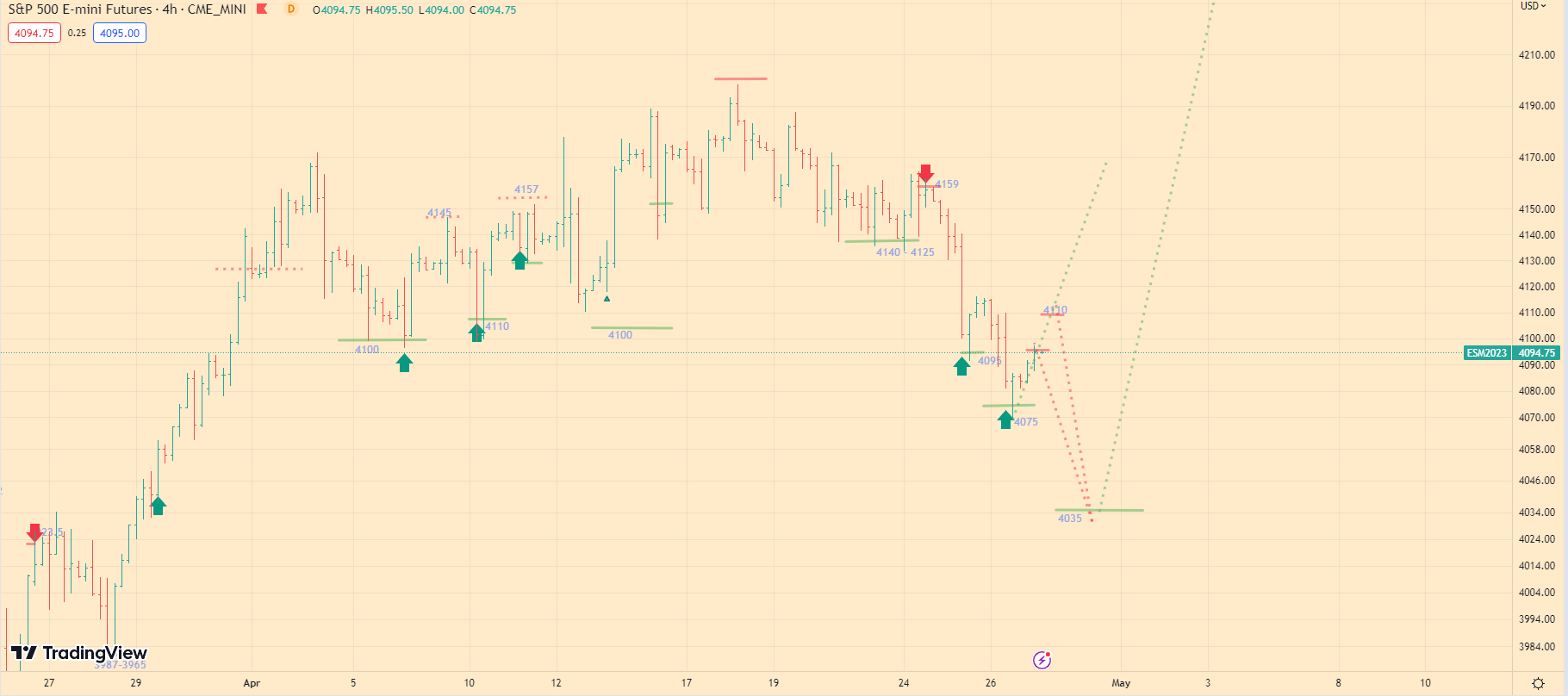

SP500 Technical Analysis ES1! futures S&P 500 Index 4-27-23

Today’s Market Overview:

Yesterday at the market opening, we saw an attempt to stabilize the index, which I mentioned earlier. However, as I predicted, the index sharply dropped to the 4075 level, which I also mentioned last week. After that, the index reached a bottom around 4069, followed by a quick profit-taking by experienced traders and medium-term investors.

Now, let’s talk about market volumes and orders currently in the market. At the moment, there are no orders from large investment funds. Right now, I see bids only from investors and experienced traders. This gives us the opportunity to understand that the market is currently expecting stabilization in movement, and if major players do not enter the market, traders will try to take advantage of this. In this case, we will see a new attempt to lower the index to the 4030-point level. This trend is already clearly manifesting in the market situation, and the new attempt will begin around the 4110 level.

Despite these challenges, I still have a positive view of the index and recommend increasing your positions from the 4030 level. I also hope you saw my previous forecasts about the index dropping to the 4095 and 4075 levels, and my recommendations to buy at these prices.

If you didn’t see my analysis yesterday, you can check it out here.

What to expect today:

As for today, I expect the index to attempt to stabilize its movement, followed by an attempt to rise to the 4110 level, where there are already many sell orders from experienced speculators. Overall, today’s trading day is likely to be negative-neutral. The main feature of today is the attempt to rise to the 4110 level, after which we will see a new attempt to push the index down to the 4030 level.

If you are long from the 4075 level, limit your losses.

Give me a thumbs up if you agree with today’s trading idea. Also, remember to contact me in 2-3 days for further trading advice. If you have any questions about my analytics and trading logic, I recommend reading the FAQ. Please share a link to my blog to help promote it. Follow me on Twitter to stay up-to-date on the S&P 500 index. Additionally, visit my About Me page to get to know me better.