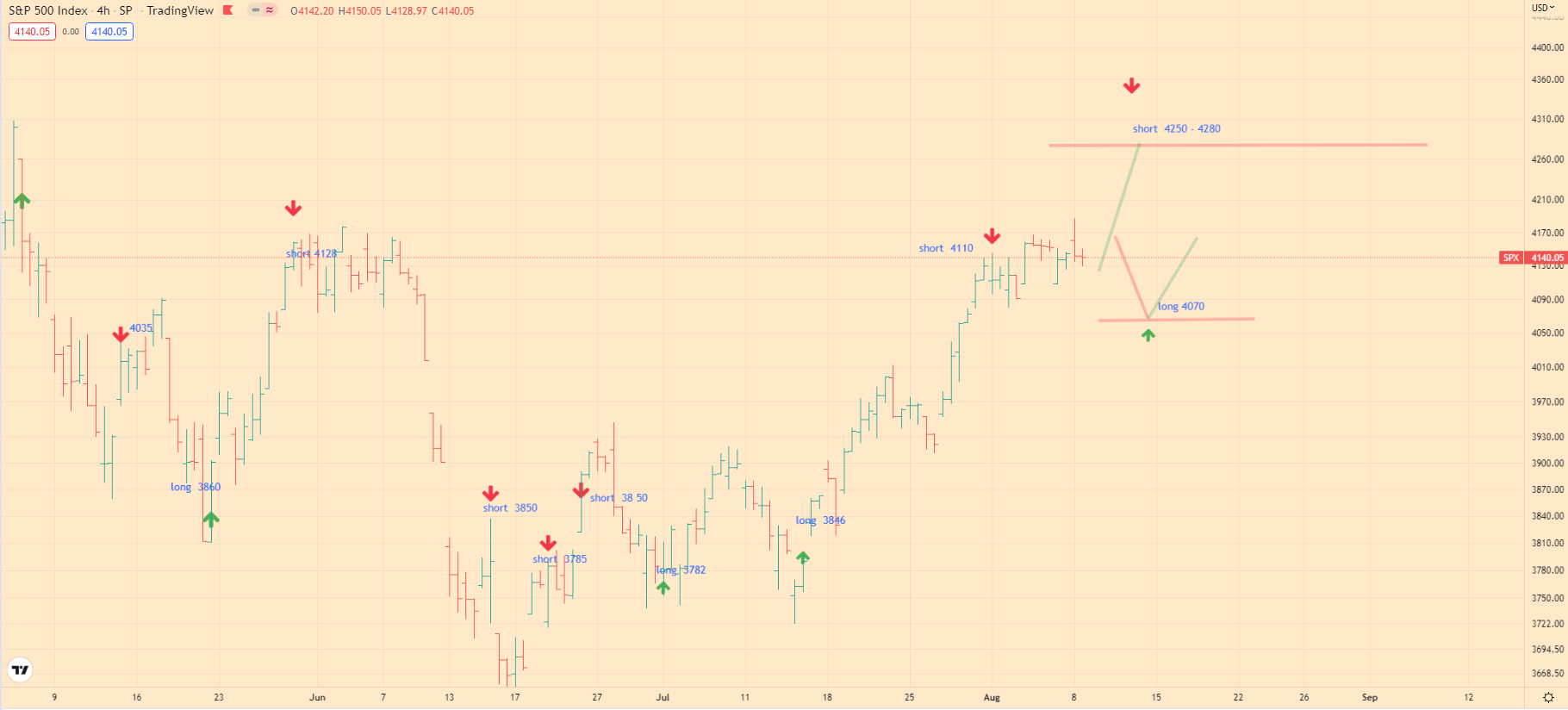

S&P 500 Index Analytics on 08/09/22:

Today we’re here to talk about the SPX 500 Index.

What’s on the market now:

Today the index is trading at 4140. And yesterday’s trading day we saw a sharp upward movement with a peak at 4180, and then profit taking. If the current trend in profit taking continues, then this may cause a correction in the market to the level of 4070, which I mentioned earlier. However, the market still has a high probability of the market moving towards the level of 4250 – 4280.

What I’m looking forward to today:

There is a high probability that the market will begin a correction and we will see a movement to the level of 4070, which will be caused by profit taking. But I maintain my positive outlook as long as the market has room for growth towards 4280.

What I recommend:

- If you want to go short:

Short positions are prohibited. However, a good opportunity would be to open short in the area of 4250 – 4280. - If you want to buy:

Buying on the market is prohibited, the market may begin a correction caused by profit taking. If you want to buy the index, then it is better to do it from the level of 4070, but limit your losses. - If you are not in the market:

If you want to buy, it’s best to place your buys at the 4070 level, but limit your losses. Short positions are possible from the level of 4250.

Like and subscribe, thanks!

Also remember to contact me in 2 or 3 days for further trading advice.

Don’t forget to like it, it really motivates me to share my market knowledge. Follow me on Twitter to stay up to date with the SPX 500. Also visit my About page to get to know me better.

See you next time!

Goodbye!