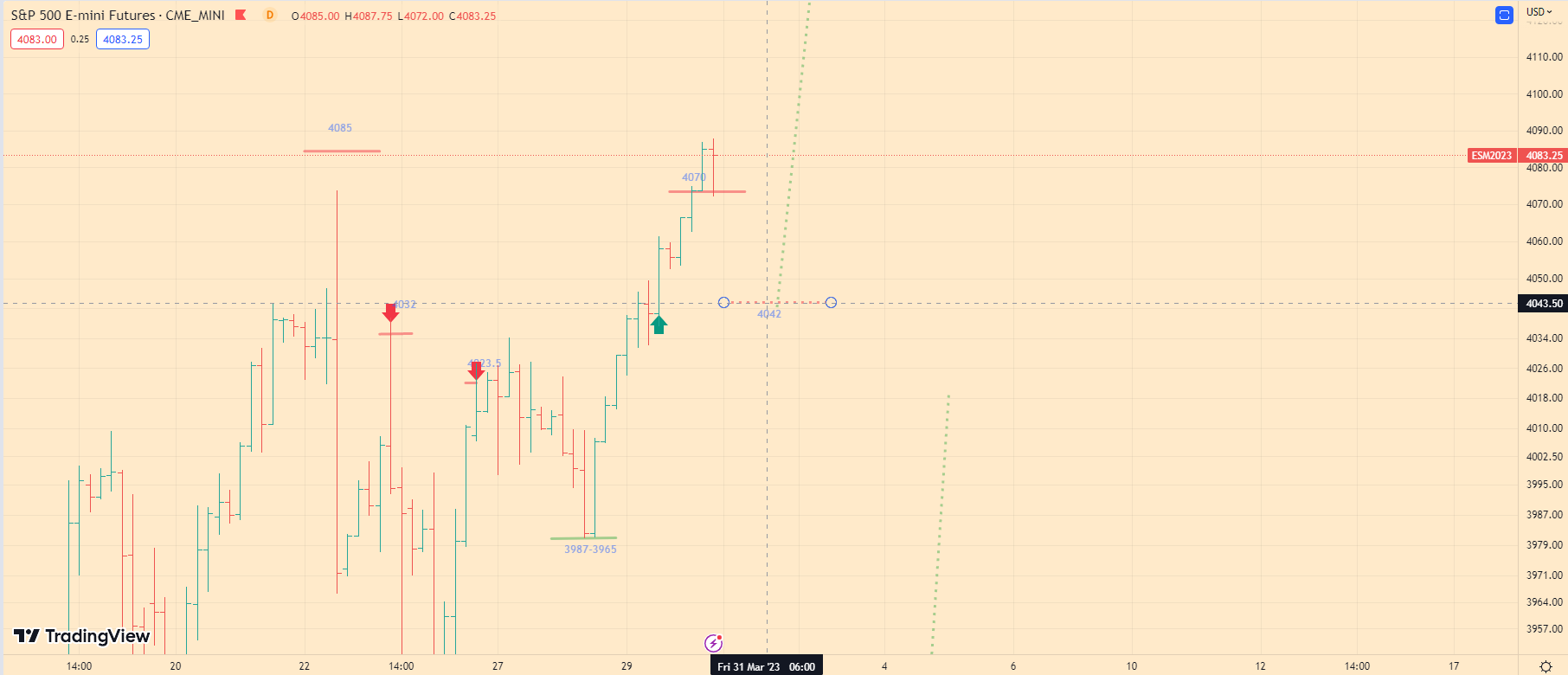

SP500 Technical Analysis ES1! futures S&P 500 Index 3-30-23

What’s on the market now:

Today the S&P500 (ES1!) is trading at 4082.

As expected, the market was positive yesterday. Currently, the market is in the process of stabilizing and has reached its level at the 4070 mark, which I mentioned earlier. However, this level was reached during the trading session in Asia, which is why we are now seeing stabilization in the movement.

Right now, the market remains positive and is moving upward towards the nearest level of 4164-4196. Speaking of trading levels, today I can highlight only two levels. The first one is at the 4042 mark. There is a significant number of orders from investors who want to enter the market at this level, and this is where the next attempt to increase the index will take place.

The second level is at the 4101 mark, where large speculators’ orders are currently placed, intending to trade on a downward trend in the short term. If this attempt is broken, we will see a sharp increase in the index towards the 4164-4196 level.

What today:

Throughout today’s trading session, I expect an attempt to stabilize the index’s movement, followed by a potential decrease to the 4042 level. However, there is a considerable volume of investors wanting to enter the market. Therefore, if this stabilization attempt is broken, we will see a sharp continuation of the upward trend towards the 4164-4196 level.

I also need your help; please support me by talking about my blog within your trading community or on your YouTube channel. Share the link with your trader friends, as it will greatly help me in promoting my blog. Recently, I received a letter from Malawi – let’s keep it up!

Give me a thumbs up if you agree with today’s trading idea. Also, remember to contact me in 2-3 days for further trading advice. If you have any questions about my analytics and trading logic, I recommend reading the FAQ. Please share a link to my blog to help promote it. Follow me on Twitter to stay up-to-date on the S&P 500 index. Additionally, visit my About Me page to get to know me better.