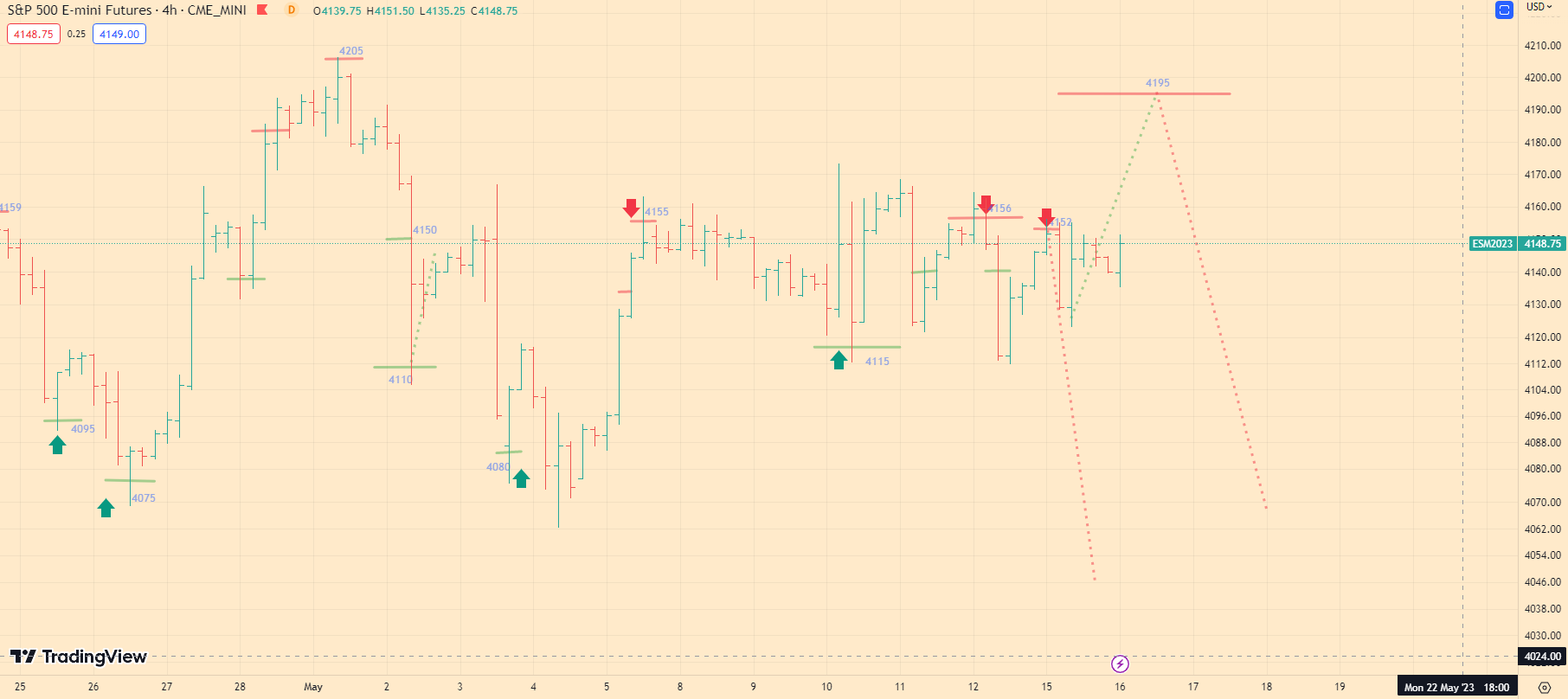

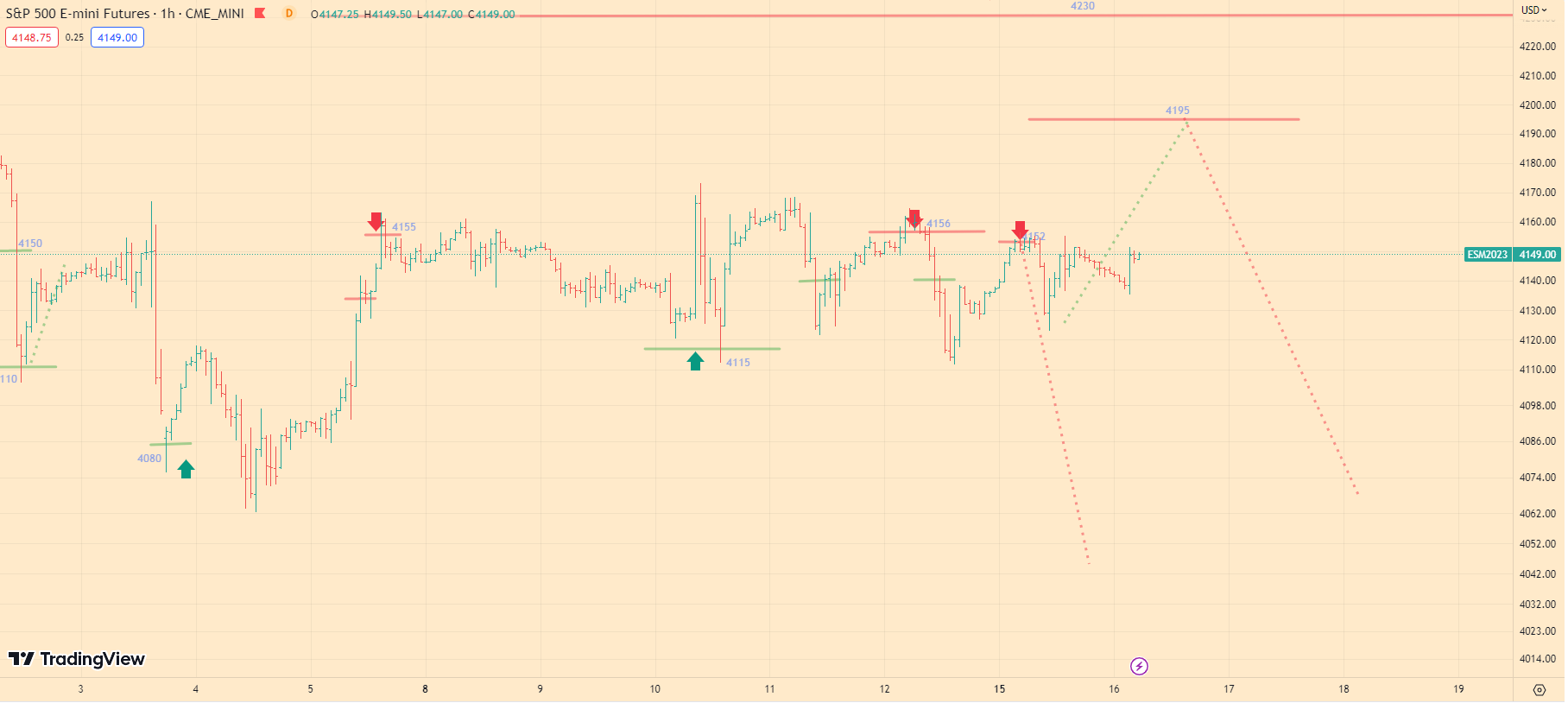

SP500 Technical Analysis ES1! futures S&P 500 Index 5-16-23

Today’s Market Overview:

Yesterday at the opening of the trading day, we saw the index sharply drop to a level around 4120, after which it attempted to rise, as I mentioned earlier. As I’ve been telling you over the past week, the market is squeezed between the levels of 4180 and 4115. However, experienced speculators have now removed orders from the 4180 level.

The main reason for this is to give the market a chance to grow. Currently, many large investment companies have set their orders at the level of 4195. Thus, the 4180 level has virtually disappeared from the market as all orders have been moved to the level of 4195.

This happened because the major players have completed the process of forming bond portfolios, and now they do not need to keep the market in a corridor. Shifting their stop-orders from the level of 4180 to the level of 4195 is important. It tells us that the market is currently becoming a playground for speculators who, understanding that the major players have achieved their goals, will try to trap inexperienced players at the level of 4195.

Now we see the market situation becoming even more complex. However, at the same time, the market has a chance to continue its growth to the level of 4310 with a stop at the level of 4195. Previously, due to the portfolio formation process carried out by the major players, the market did not have this opportunity.

If you didn’t see my analysis yesterday, you can check it out here.

What to expect today:

Today at the opening of the trading day, I expect the index to make another attempt to drop to the level of 4130. Here, a new attempt will be made to raise the index, and now the market has every chance to rise to the level of 4195. But if this attempt fails, we will see a drop in the index to the level of 4000 and below.

Give me a thumbs up if you agree with today’s trading idea. Also, remember to contact me in 2-3 days for further trading advice. If you have any questions about my analytics and trading logic, I recommend reading the FAQ. Please share a link to my blog to help promote it. Follow me on Twitter to stay up-to-date on the S&P 500 index. Additionally, visit my About Me page to get to know me better.