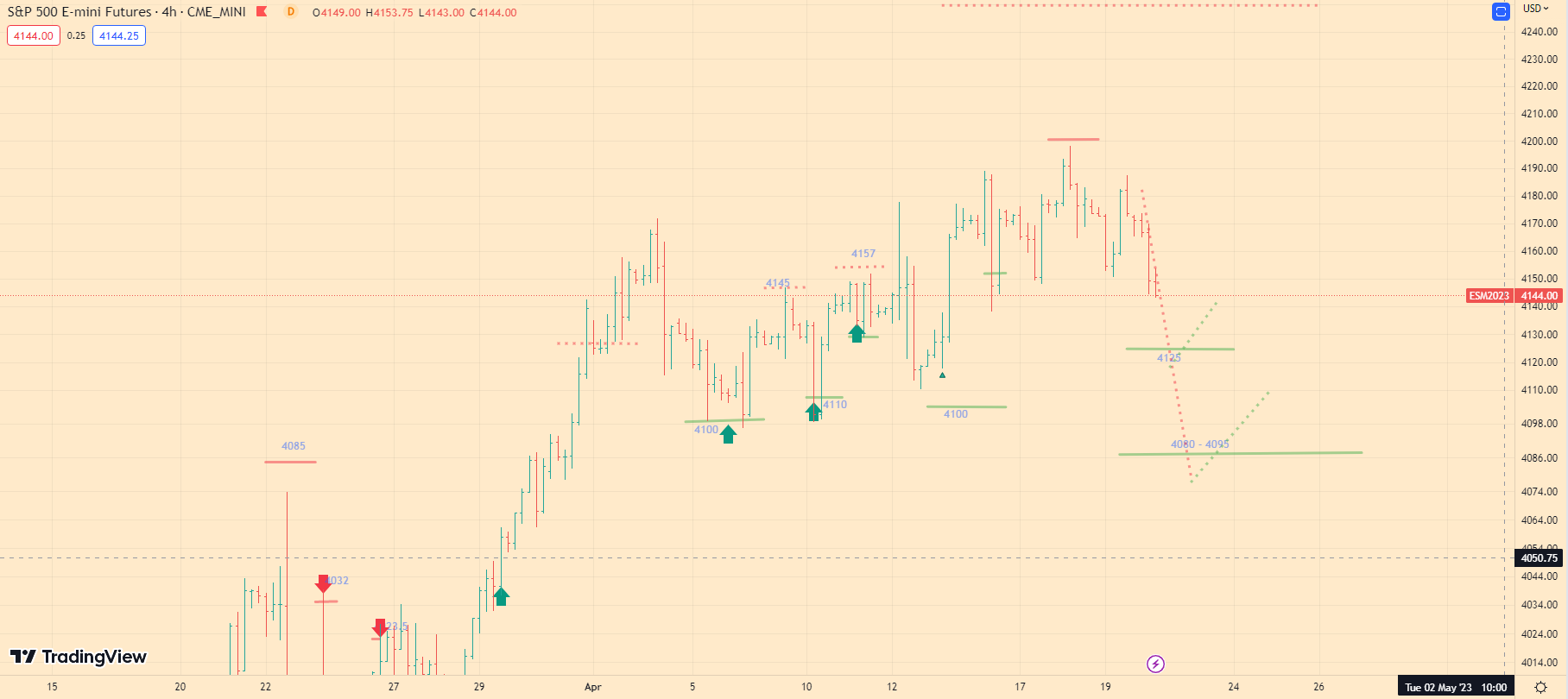

SP500 Technical Analysis ES1! futures S&P 500 Index 4-20-23

Today’s Market Overview:

Yesterday at the market open, we saw the index start its growth and reach a level of 4180, after which it continued to decline to the level of 4125 – 4070, which I mentioned earlier.

Currently, the index continues its downward trend. As I said, the nearest reversal point will be the 4140 – 4125 level where speculators will try to push the market upward. However, if this attempt fails, we will see a further decline of the index to the 4070-4095 level, where we’ll need to look for new opportunities to open long positions.

I also need to note that major market players remain positive, and there is a large amount of liquidity that could potentially trigger a sharp rise in the index to the level of 4250 and above.

For this reason, it’s necessary for us to increase our positions on pullbacks. A favorable decision would be to buy at the 4070 level.

If you didn’t see my analysis yesterday, you can check it out here.

What to expect today:

Today at the market open, I expect the index to attempt stabilization before dropping to the 4125 level, where it will make its last growth attempt. However, if this attempt fails, we will see a further sharp decline to the 4070 level.

Give me a thumbs up if you agree with today’s trading idea. Also, remember to contact me in 2-3 days for further trading advice. If you have any questions about my analytics and trading logic, I recommend reading the FAQ. Please share a link to my blog to help promote it. Follow me on Twitter to stay up-to-date on the S&P 500 index. Additionally, visit my About Me page to get to know me better.