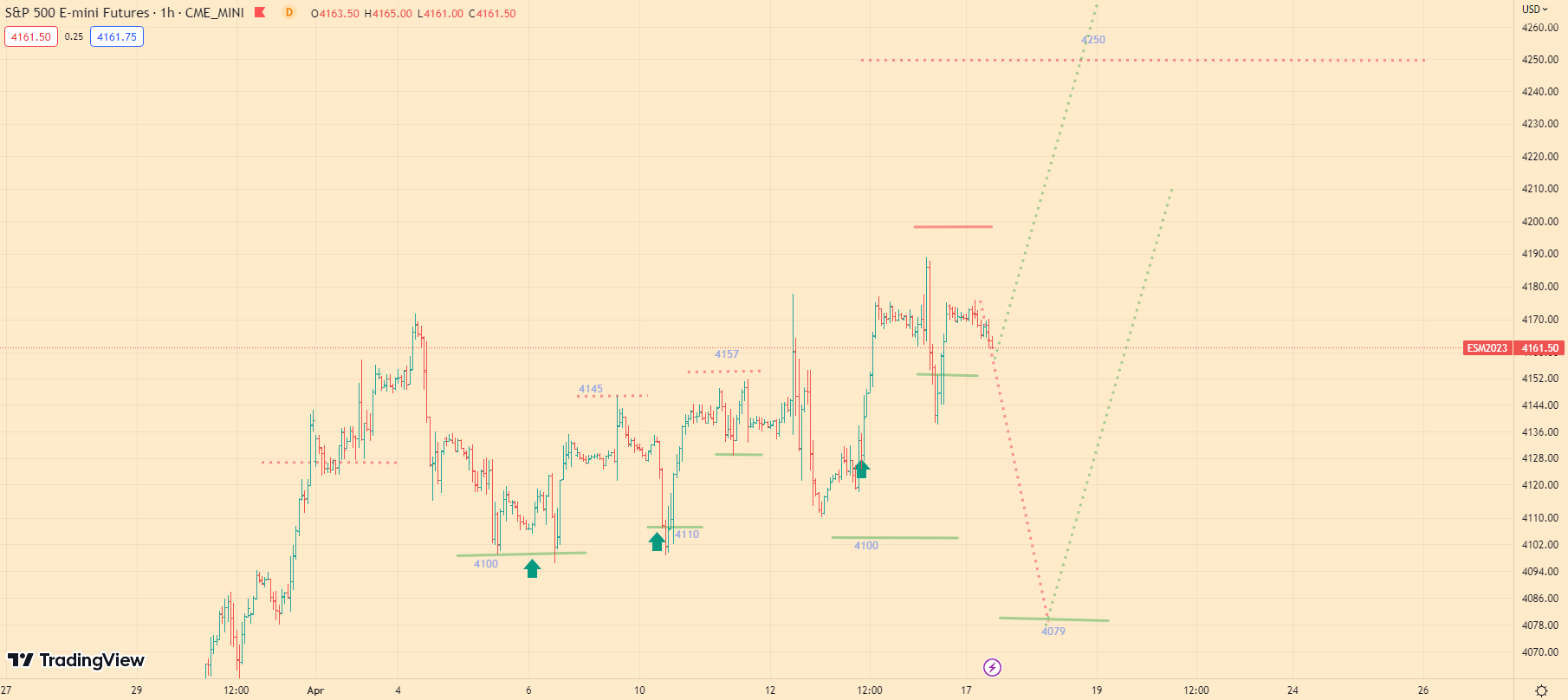

SP500 Technical Analysis ES1! futures S&P 500 Index 4-17-23

Today’s Market Overview:

In the last trading session, which was on Friday, we saw an attempt for the index to grow. However, this attempt was weak. As I mentioned in the previous market review, there are all the reasons for a sharp increase, but if the major players do not start buying, the market will drop into a minor correction.

This correction may take a few days. I expect the bottom of this possible correction to be around 4070-4080. So, in this part of the market review, everything remains the same as it was a few days ago.

As I mentioned to you earlier, the market remains positive and is moving towards the 4310 level, with a stop at the 4250 level. However, right now, such a development is not obvious to many market participants, and a correction to the 4070 level seems more attractive to them. That’s why, at this moment, we should be prepared to encounter 4070, where we can increase our positions.

In fact, we should be trading on pullbacks and buying the bottom of a minor correction.

What to expect today:

Today, at the opening, market make a minor attempt to grow in the first half of the day. I believe that the market has a chance for growth. However, if this attempt is broken, we will see a sharp drop in the index to the 4070-4080 level. That’s where we will need to look for opportunities to open long positions. Today, caution is necessary as the market may experience sharp movements.

I also need your help; please support me by talking about my blog within your trading community or on your YouTube channel. Share the link with your trader friends, as it will greatly help me in promoting my blog. Recently, I received a letter from Malawi – let’s keep it up!

Give me a thumbs up if you agree with today’s trading idea. Also, remember to contact me in 2-3 days for further trading advice. If you have any questions about my analytics and trading logic, I recommend reading the FAQ. Please share a link to my blog to help promote it. Follow me on Twitter to stay up-to-date on the S&P 500 index. Additionally, visit my About Me page to get to know me better.