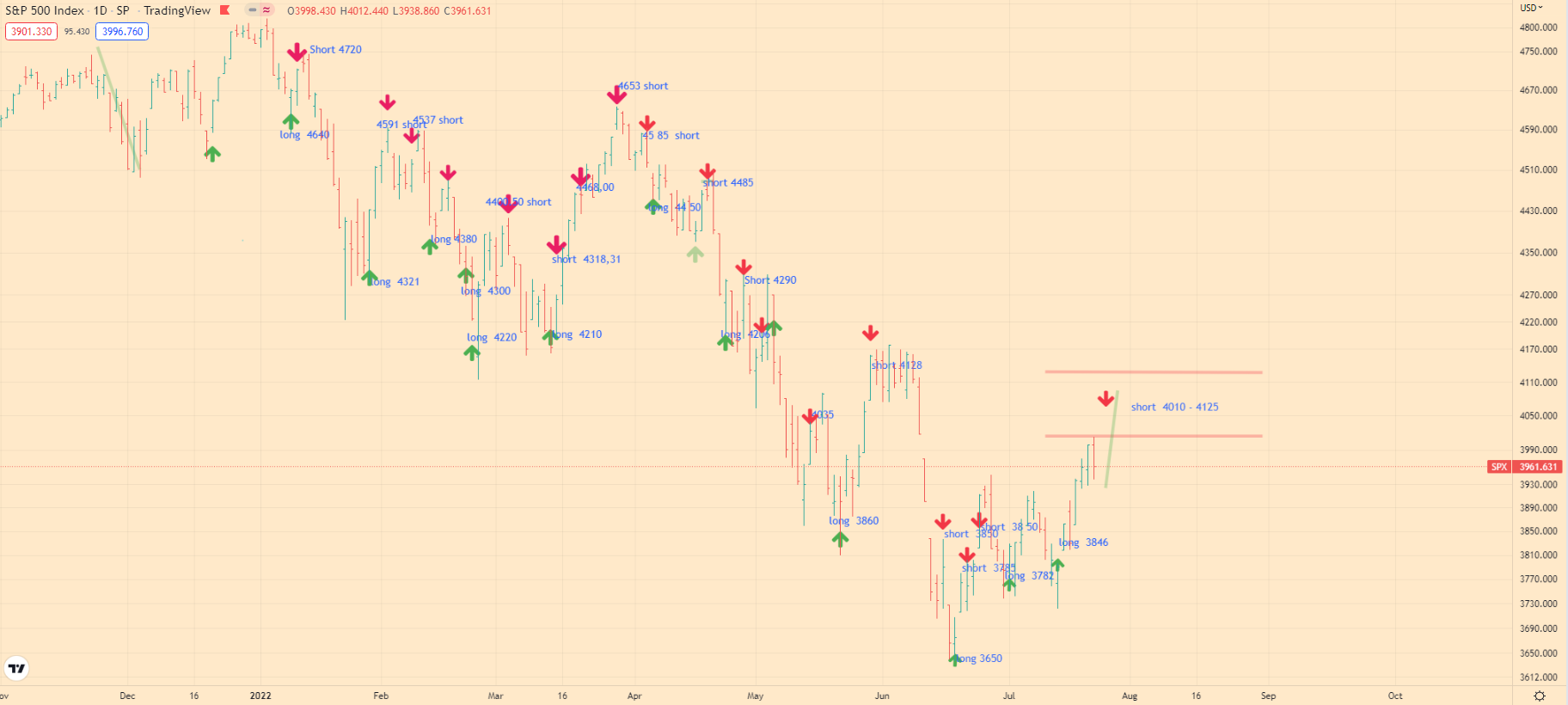

SNP 500 Index Analytics on 7/25/22:

Today we’re here to talk about the SPX 500 Index.

What’s on the market now:

The index is trading at the level of 39 61. And last week it came out of the side correction, in which it had been since June 21. And continued to move to the level of 4010 – 4125.

In the last trading session, we saw how the price reached 1 level 4010. And therefore, now I expect a correction to develop in the 3900 area. It is important for us to remember that, according to my forecasts, the market should reverse between 4010 and 4125. The market has fulfilled the minimum conditions for a reversal. Therefore, I am changing my outlook from optimistic to neutral.

However, the market still has a high probability of the index moving to the 4100 zone. Here is a link to the idea.

What I’m looking forward to today:

Today I expect the development of a correction and a decline to the level of 3870. My positive attitude towards the market has changed. Now I estimate the market as neutral, but its movement to the level of 4100 is preserved.

Today I am changing my trading recommendations for the index.

What I recommend:

- If you want to go short:

Short positions are prohibited. - If you want to buy:

Buying on the market is prohibited, trading up from the level of 3870 is possible, but limit your losses. - If you are not in the market:

If you want to buy the index, then it is better to do it from the level of 3870, but limit your losses. Short positions are possible from the level of 4100.

Like and subscribe, thanks!

Also remember to contact me in 2 or 3 days for further trading advice.

Don’t forget to like it, it really motivates me to share my market knowledge. Subscribe to me on Twitter and you will always be aware of the movement of the SPX 500 index.

See you next time!

Goodbye!