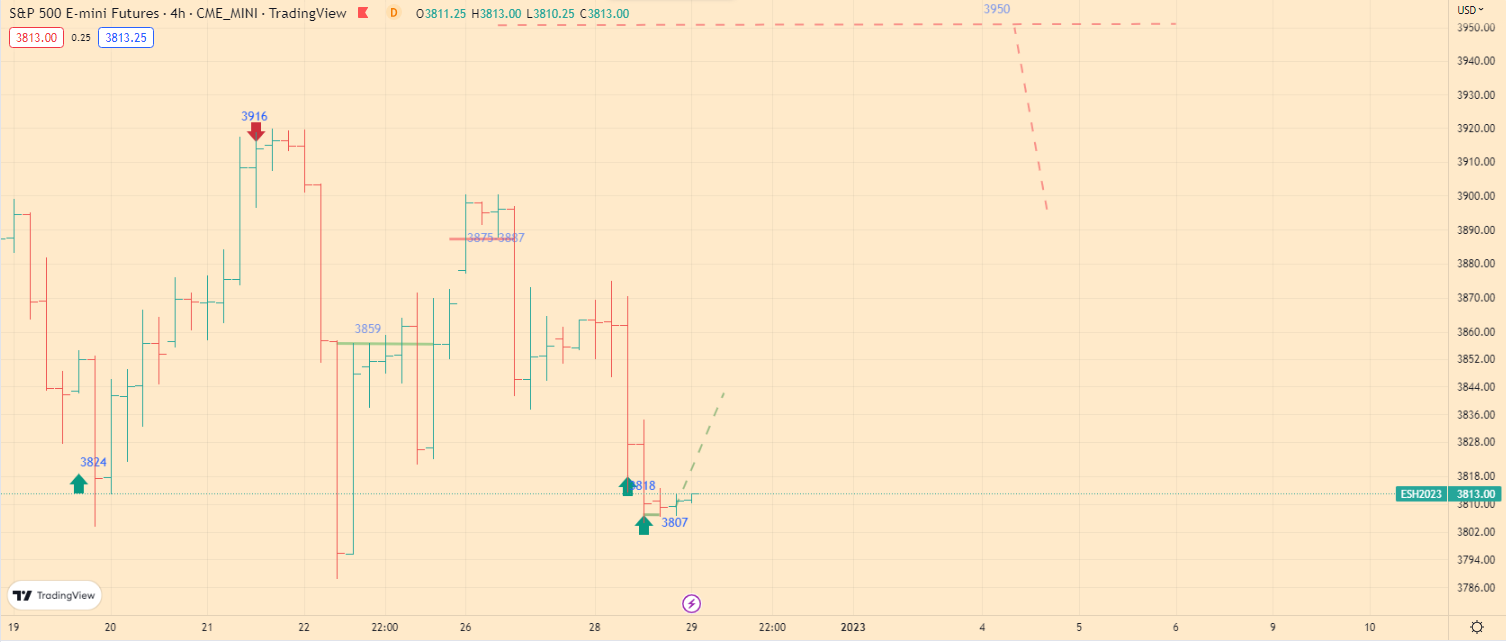

Analysis of the S&P 500 index 12.29.22

What’s on the market now:

Today the index is trading at the level of 3812. Yesterday we saw the movement of the index to the level of 3820, which I mentioned earlier. At the moment, the movement of the index has stabilized. As I said earlier, the index has a good chance of rising to the level of 3950. However, at the current time, the index is under strong pressure from small players. Now the index has one last chance for a sharp rise to the level of 3950. But if this attempt is broken, then we will see a correction to the level of 3730 and below.

What today:

Today at the open of the market, I expect the index to make one last attempt to rise to the level of 3950. However, if this attempt is frustrated, then we will see a sharp drop in the index to the level of 3730 – 3660. Be careful, limit your losses.

Here’s what I mentioned yesterday and what it looks like today.

Here are my trading recommendations for today 12.29.22

What I recommend:

- If you want to open a short position:

Short positions are possible from 3950 level, limit your losses

- If you want to buy:

Long positions are possible from 3660 level, limit your losses.

- If you are not in the market:

If you’re out of the market. Then you need the perfect price to trade. Long positions are possible from pullback or from 3660 level. If you want to open a short position, then it is better to do it from the level of 3950. Limit your losses.

Please note that my S&P 500 analysis is current as of the publication date. In fact, I am arguing that the analysis is correct only at the time of its publication and may be incorrect even a few hours after its publication. This is due to the fact that I analyze the trading volumes that are on the exchanges, and therefore it makes sense for you to follow me on Twitter. Or join my telegram trading channel.

Click the thumbs up if you agree with today’s trading idea. Also remember to contact me in 2 or 3 days for further trading advice. If

you have any questions about analytics and my trading logic, then I recommend that you read the FAQ section. Also share a link to my blog, it will greatly help in its movement.

Follow me on Twitter to stay up to date on S&P 500 index. Also visit my about me page to get to know me better. If you like the content of my blog, you can make a donation to support the blog.