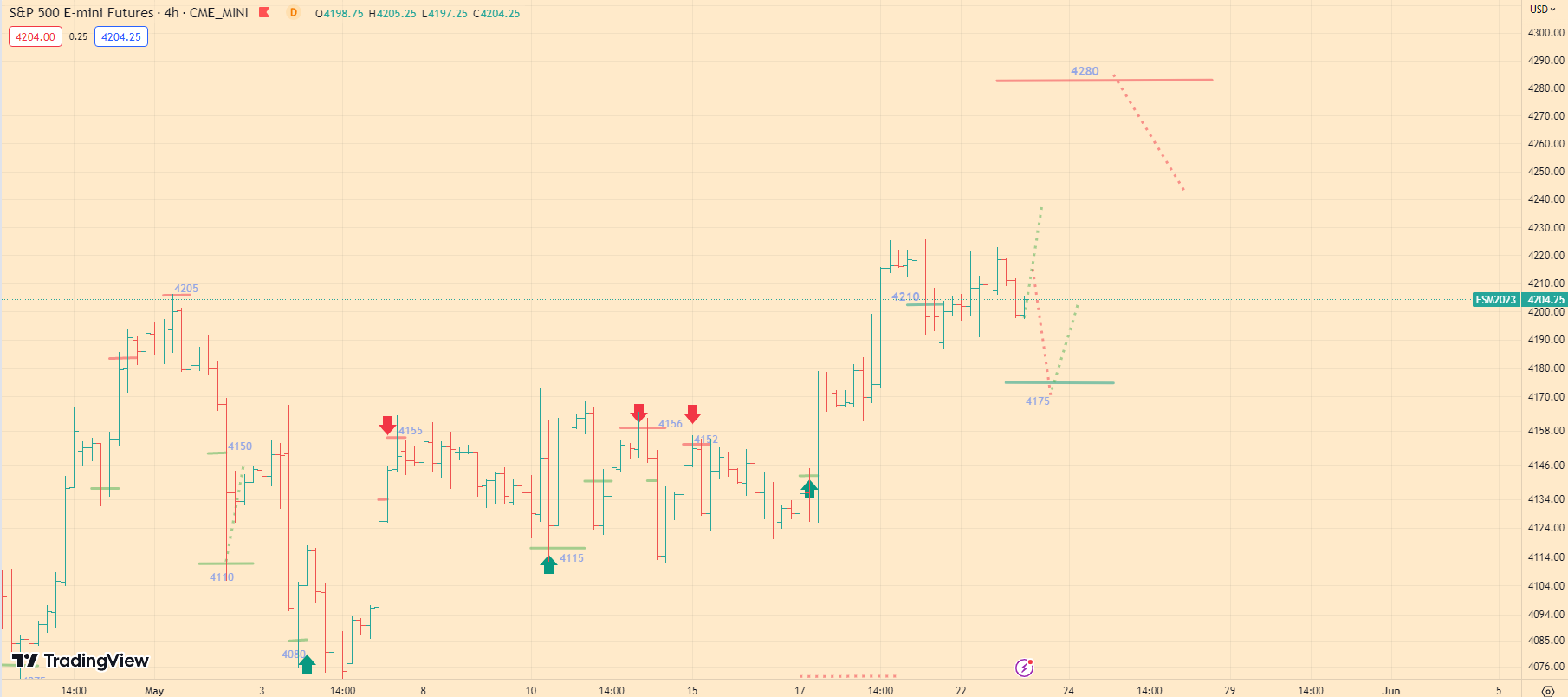

SP500 Technical Analysis ES1! futures S&P 500 Index 5-23-23

Today’s Market Overview:

Yesterday at the start of the trading day, we saw the index attempt to rise to the level of 4220, after which a correction began, which I also mentioned earlier.

As I mentioned in my review yesterday, I expect the index to reach the level of 4280. Here, we should expect a more serious correction that will likely last for 3-4 days. After this, I anticipate the index will continue its rise to the level of 4310 and beyond.

However, currently there are all possibilities for the market to stabilize with a subsequent decline of the index to the level of 4175. The probability of a decrease to this level currently exists, but it’s not mandatory. At the opening of today’s trading day, many speculators may purchase at the market price, fearing to miss the opportunity to buy at a more favorable price. That’s why today at the market opening, we have a chance for a sharp rise of the index to the level of 4280.

Now let’s discuss the current volumes in the market. Today, large investment companies have placed their buy orders around the level of 4175. The target for profit-taking is now the level of 4280. As far as I know, some major players will be taking profit at this level, which may cause a halt to the index’s growth, regardless of its strength and momentum.

If you didn’t see my analysis yesterday, you can check it out here.

What to expect today:

Today at the market opening, I expect the index to attempt to rise to the level of 4215. However, if this growth attempt is broken, we will see a further decline of the index to the level of 4175. Another important point for us today is that at the moment, many speculators want to enter the market, fearing to miss out. If at the start of the trading day they purchase at the market price, we will likely face a slight correction.

Give me a thumbs up if you agree with today’s trading idea. Also, remember to contact me in 2-3 days for further trading advice. If you have any questions about my analytics and trading logic, I recommend reading the FAQ. Please share a link to my blog to help promote it. Follow me on Twitter to stay up-to-date on the S&P 500 index. Additionally, visit my About Me page to get to know me better.