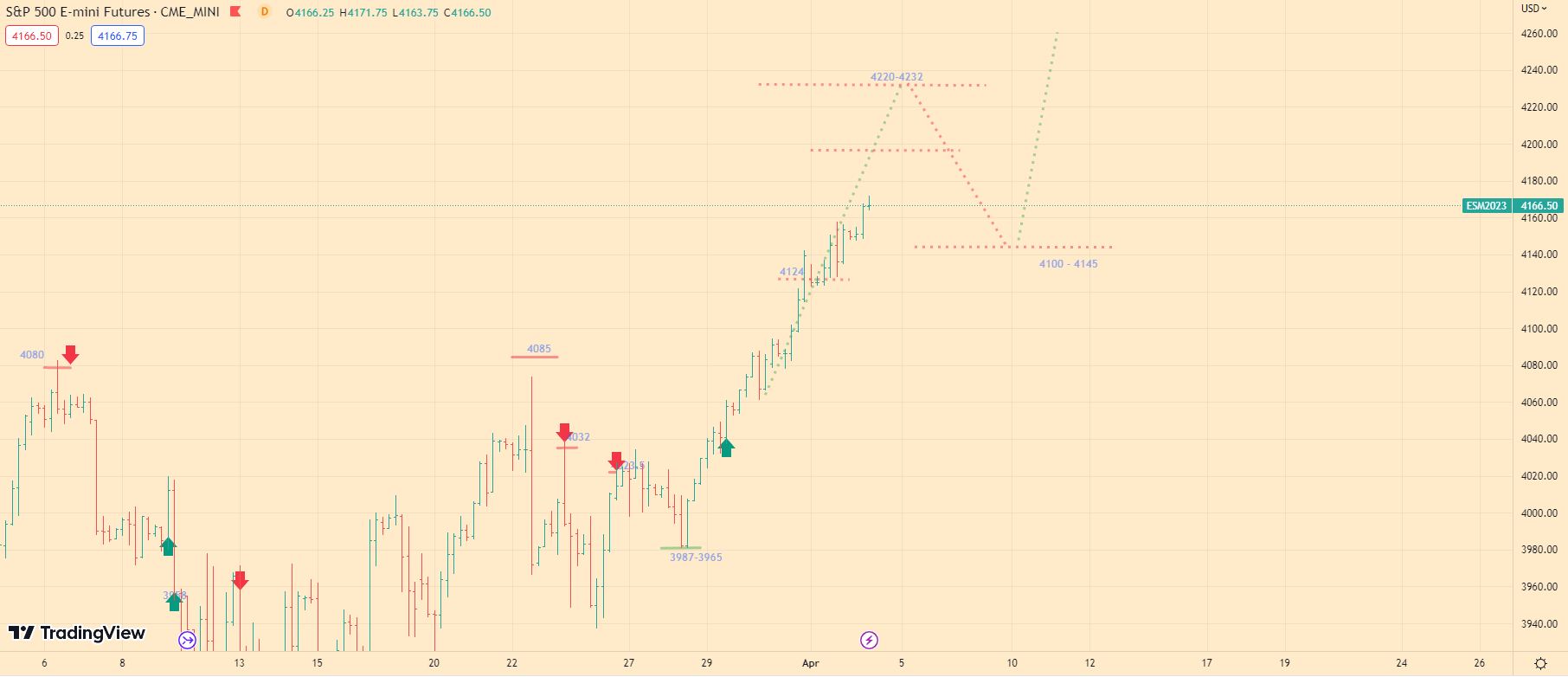

SP500 Technical Analysis ES1! futures S&P 500 Index 4-4-23

Today’s Market Overview:

Today the S&P500 (ES1!) is trading at 4166.

Yesterday, we saw the index continue its upward movement toward the 4197 level. Currently, the market is in a stable uptrend. However, after analyzing market volumes today, I have concluded that the market peak will actually be higher than the level I previously mentioned. The new level at which we should expect a peak and subsequent confident market stabilization is somewhere between 4220 and 4232.

I anticipate that medium-term investors will begin actively locking in profits at this level, reevaluating their plans due to the strong growth. As I mentioned in late March, the index is moving toward the 4164-4196 range, and it has now nearly reached this target, entering the zone of an expected reversal. But at this point, I expect the index to attempt to pause and stabilize its movement near the upper boundary of this level, around 4197. This pause in growth will primarily be caused by profit-taking from speculators who opened their positions earlier. However, significant market exits by medium-term investors will occur slightly higher.

If you didn’t see my analysis yesterday, you can check it out here.

What to expect today:

Today, upon market opening, I expect the index to try stabilizing at the 4150 level before further increasing to the 4197 level and beyond. As I mentioned earlier, we should anticipate an attempt to stabilize the index here due to profit-taking.

I also need your help; please support me by talking about my blog within your trading community or on your YouTube channel. Share the link with your trader friends, as it will greatly help me in promoting my blog. Recently, I received a letter from Malawi – let’s keep it up!

Give me a thumbs up if you agree with today’s trading idea. Also, remember to contact me in 2-3 days for further trading advice. If you have any questions about my analytics and trading logic, I recommend reading the FAQ. Please share a link to my blog to help promote it. Follow me on Twitter to stay up-to-date on the S&P 500 index. Additionally, visit my About Me page to get to know me better.