S&P 500 Index Analytics on 10/20/22:

Today we’re here to talk about the S&P 500 Index.

What’s on the market now:

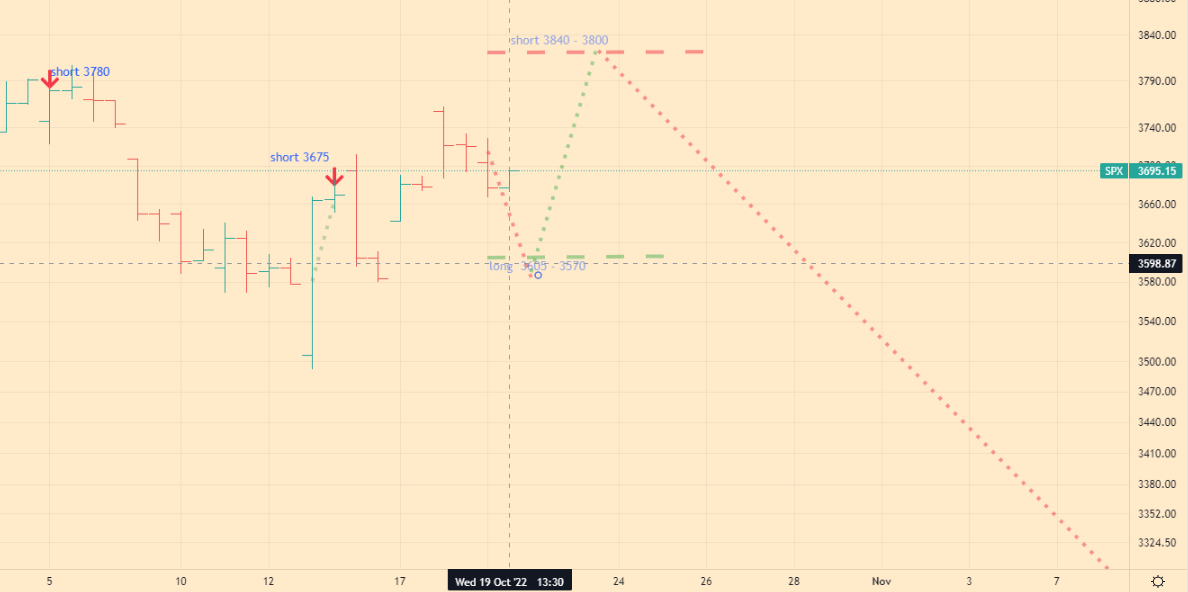

Today the index is trading at 3695. And over the past trading day, we saw a slight decrease in the index, but there was no sharp drop, the market continues to be in the support zone. Today the market has every chance to fall to the level of 3605. However, if this attempt is broken, the market will fall to the level of 3200. Thus, globally, nothing changes.

What today:

Today at the open, I expect the market to try again to drop to the level of 3605-3670. But there is also a high probability of a sharp fall to the level of 3200 on the market. Therefore, long positions are prohibited.

Here are my trading recommendations for today 10/20/22

What I recommend:

- If you want to open short:

Short positions are possible from the 3840-3815 level, this will be the ideal place to sell thon the way to the local peak at 3840 is week, limit your losses. - If you want to buy:

Long positions are possible from the level of 3605-3580. Limit your losses, there is a possibility of a sharp fall towards the 3200 level. - If you are not in the market:

Long positions are possible from the 3605-3580 level, If you want to open a short position, then it is better to do it from the level of 3840 – 3815 limit your losses.

Give me thumbs up. Also remember to contact me in 2 or 3 days for further trading advice. Also share a link to my blog, it will greatly help in its movement.

Follow me on Twitter to stay up to date with the S&P 500. Also visit page about me to get to know me better. If you like the content of my blog, you can make a donation to support the blog.